Are you struggling to manage your finances? Do you live paycheck to paycheck, with little to no savings? You’re not alone. Many people struggle with budgeting, but the Calendar Method can make managing your finances easy.

What is the Calendar Method?

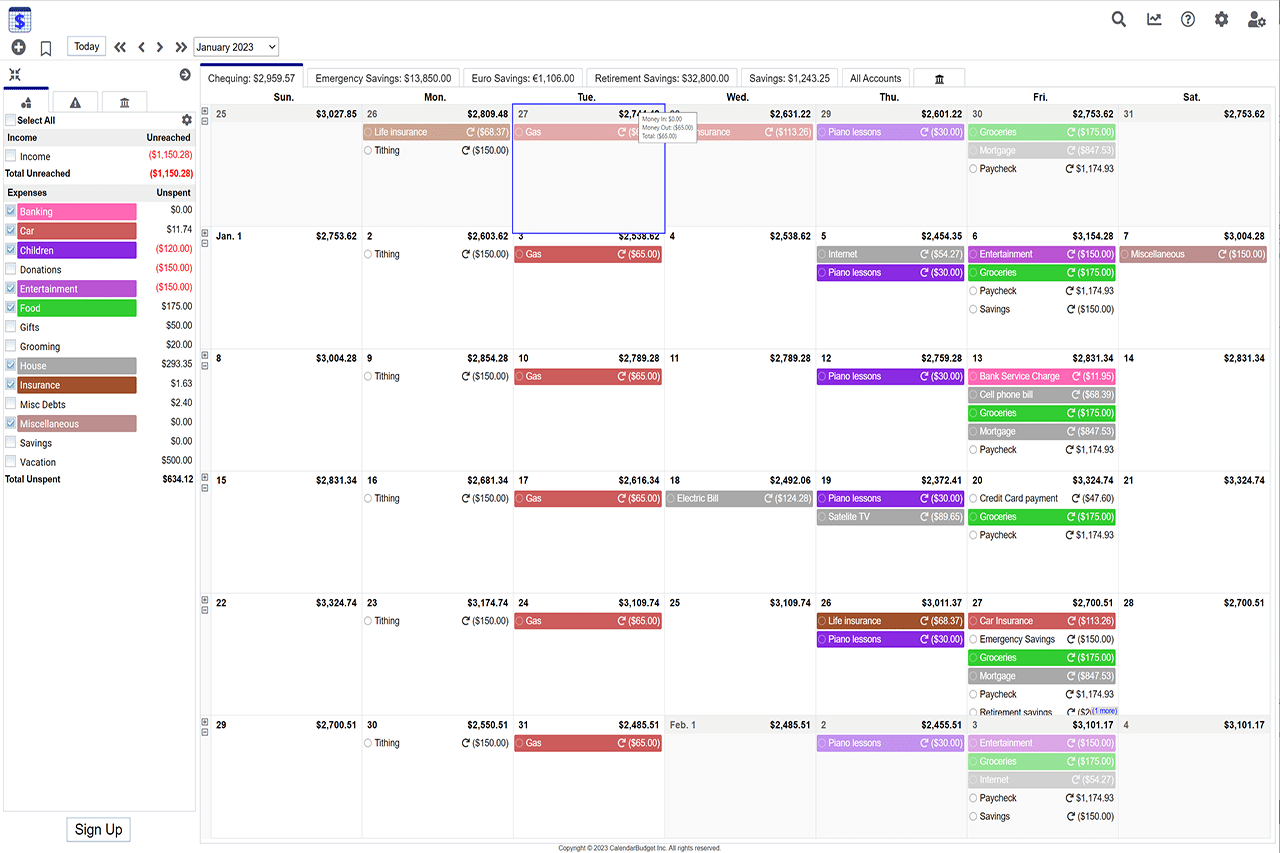

Budgeting with a calendar is a simple yet effective way to make money struggles a thing of the past. With the calendar method, you list your income and expenses on a calendar and add them up so you know your account balance on any given day. This lets you visualize your finances day-by-day, week-by-week, and month-by-month, helping you make a solid financial plan for your future.

How Does the Calendar Method Work?

The calendar method involves breaking down your income and expenses into a weekly or monthly calendar, which you can then use to monitor your cash flow and adjust your spending accordingly.

Before you begin, here’s what you will need:

- Your banking records for the past one to three months for each of your bank accounts and credit card(s). You can use your printed bank statements or your online banking records

- A calendar that you can use to track your income and expenses. You can use a physical calendar or an electronic monthly calendar budget app on your desktop or mobile (which being electronic, makes it a lot easier to get started and maintain your budget over time), whichever you prefer

- A pencil and eraser for easy adjustments to your plan (if using a physical calendar),

OR a computer or mobile device for the electronic format - A calculator maybe needed for any manual calculations

- Be prepared to note any upcoming financial surprises or specific financial needs so you can plan to be ready for them

With all your materials gathered, let’s go through the setup one step at a time.

- Track The Previous 1-3 Months:

First, start by listing your incomes on your calendar on the day they’ve happened over the last one to three months. List the name and amount. Include your salary, commissions, side hustles, and other income streams. Confirm with your bank records to make sure nothing is missed.

Next, list all your expenses on the day they happened, including fixed expenses like rent, mortgage payments, and car payments, as well as all variable expenses like groceries, entertainment, and clothing. Consult your bank records again to ensure you have included all your expenses.

Bonus: Categorize each income/expense (by color) as you go. You may want to use categories like housing, auto/car, grooming, food, and more. Whatever is meaningful to you. This will help you visualize where you spend most of your money. You may be surprised to find you spend more than you expected on something like food or a hobby. - Plan Your Future:

Looking back over your recent history, find income and expenses that repeat.

For each source of income, determine how often it repeats and for how much. Then add it to your calendar on each expected day over the next 6-months (or two years if you’re feeling ambitious!). If the amount varies, use the lower amount to plan by, and enjoy pleasant surprises when you earn more than expected.

Follow these same steps for each of your expenses. For example, “Gas” for the car every other Wednesday or “Groceries” every Friday. Plan on the higher side for expenses to avoid unwanted surprises.

Also, plan for occasional expenses, such as birthdays, vacations, or upcoming big-ticket purchases. With these as part of your plan, you’ll be better able to save for these expenses over time and avoid debt.

- Track The Previous 1-3 Months:

- Calculate Your Daily Account Balances:

NOTE: If you’re using a calendar budget app, this step will be done automatically!

Look back at your very first transaction on your calendar (which should be one to three months ago). Determine what your account balance is on the day just before this day. Write that account balance at the top of that day. Then, for every day following, calculate the updated account balance by adding income and subtracting expenses that happened that day, writing the new balance at the top of every day. Repeat this step as far into the future as you dare to plan. This is a lot of math! So you can see why using an app makes sense, as it does the calculations for you, and you can avoid human error!

- Make Adjustments To Reach Your Goals:

Review your end-of-day balances for the next 2-3 months, and make sure you never go below zero. Or, even better, check that you never go below a minimum threshold you set for yourself, like $500. If you dip below this threshold, move, reduce, or eliminate expenses to give your budget some breathing room.

With a plan in place, you’ll be able to see your spending by category. Set a realistic budget amount for each spending category. Then, add up the transactions for each month (by category) to see if you’re living within the budget you set. Make adjustments to live within your category budgets. - Update Regularly:

At the end of every day, or at least several times per week, update your calendar with what has actually happened in your bank account.

Are there any unplanned incomes or expenses? Add these to your calendar and set them up to repeat over the next 6-months to two years, just as you did before.

Have your plans changed? If so, move future planned expenses to where they belong.

If you’re doing this manually, re-calculate your end-of-day balances for each change you make so everything is up to date.

Benefits of the Calendar Method

The calendar method has many benefits to make budgeting much easier for you, including:

- Simplicity: The calendar method is easy to use and doesn’t require any complicated spreadsheets

- Natural: Since we all live by calendared dates for events and activities, budgeting like this makes it easy to understand without having to learn some complicated process

- Visualization: Seeing your income and expenses on a calendar makes it easy to visualize your finances and identify areas where you may need to cut back

- Planning: The calendar method allows you to plan for the future and save up for major expenses over time

- Flexibility: The calendar method is flexible, allowing you to adjust your budget as needed to accommodate changes in your income or expenses

Make money struggles, debt, and living paycheck to paycheck a thing of the past. Get started with the Calendar Method today and discover how organized finances make for less stress and bring great hope and success for your future.

Good evening Eric… I’m back… for good this time. I wanted to try keeping track on my own with a spreadsheet… but I’m a moth to a flame with calendar budgeting. So, I’ll stick with it this time.

One thing I can’t get my head around: When I purchase something with a credit card and record the expense, why do I have to record the transfer from checking to the card to pay it as an expense as well? Isn’t this double-counting the expense for that event? Is there some other way to record this without skewing the expense totals?

When using a credit card, the original purchase is the only transaction that counts against your budget.

Later, when you make a “transfer” from your bank account to your Visa to make a payment, it’s a debit to your bank account and a credit to your credit card for the same amount and same category, so it has no effect on your budget. Transfers do not affect budgets, you are simply moving money from one account to another.